Not known Factual Statements About Hsmb Advisory Llc

Not known Factual Statements About Hsmb Advisory Llc

Blog Article

The Single Strategy To Use For Hsmb Advisory Llc

Table of ContentsThe Main Principles Of Hsmb Advisory Llc Hsmb Advisory Llc - An OverviewFascination About Hsmb Advisory LlcHsmb Advisory Llc for Dummies

Life insurance is particularly essential if your household is dependent on your salary. Market experts recommend a plan that pays out 10 times your yearly revenue. These might include mortgage repayments, exceptional finances, credit rating card financial obligation, taxes, kid care, and future college prices.Bureau of Labor Statistics, both partners worked and brought in earnings in 48. They would certainly be most likely to experience financial hardship as an outcome of one of their wage earners' fatalities., or private insurance policy you acquire for on your own and your family by speaking to health insurance policy business directly or going via a wellness insurance coverage agent.

2% of the American population lacked insurance policy protection in 2021, the Centers for Disease Control (CDC) reported in its National Center for Wellness Stats. Greater than 60% obtained their coverage via a company or in the private insurance policy marketplace while the remainder were covered by government-subsidized programs consisting of Medicare and Medicaid, professionals' advantages programs, and the government marketplace developed under the Affordable Care Act.

All about Hsmb Advisory Llc

If your income is reduced, you might be one of the 80 million Americans who are eligible for Medicaid.

According to the Social Safety and security Administration, one in four workers entering the workforce will certainly come to be impaired before they reach the age of retired life. While health insurance pays for hospitalization and medical bills, you are usually strained with all of the costs that your paycheck had actually covered.

Many policies pay 40% to 70% of your revenue. The cost of handicap insurance policy is based on several factors, consisting of age, way of life, and wellness.

Several plans call for a three-month waiting period prior to the insurance coverage kicks in, provide a maximum of three years' worth of protection, and have substantial policy exclusions. Here are your choices when purchasing vehicle insurance coverage: Responsibility protection: Pays for residential property damage and injuries you trigger to others if you're at mistake for an accident and also covers litigation prices and judgments or negotiations if you're taken legal action against due to the fact that of a car mishap.

Comprehensive insurance coverage covers theft and damages to your auto due to floods, hail, fire, criminal damage, dropping items, and pet strikes. When you finance your vehicle or rent a cars and truck, this sort of insurance is mandatory. Uninsured/underinsured driver (UM) click here for more coverage: If an uninsured or underinsured chauffeur strikes your lorry, this coverage pays for you and your passenger's medical costs and may likewise represent lost earnings or make up for pain and suffering.

Company coverage is commonly the very best option, yet if that is unavailable, acquire quotes from a number of suppliers as several give discounts if you buy greater than one kind of protection. (https://www.topratedlocal.com/hsmb-advisory-llc-reviews)

Examine This Report about Hsmb Advisory Llc

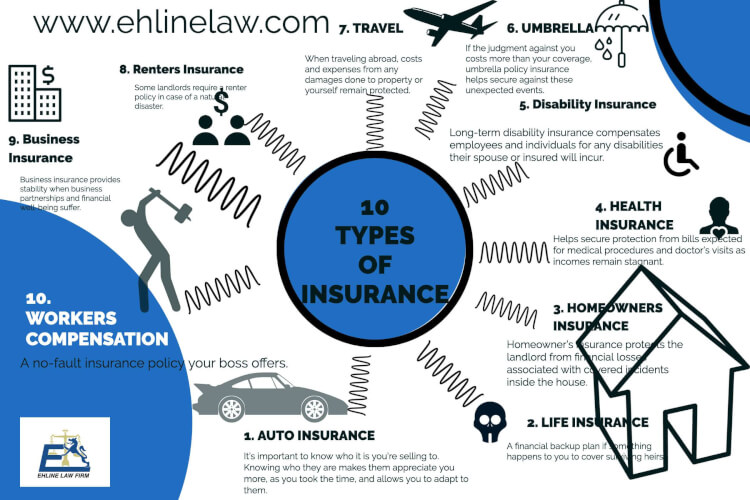

In between wellness insurance coverage, life insurance policy, handicap, obligation, lasting, and even laptop insurance, the task of covering yourselfand considering the countless opportunities of what can happen in lifecan really feel overwhelming. As soon as you recognize the principles and make certain you're adequately covered, insurance can increase economic self-confidence and well-being. Below are one of the most vital types of insurance policy you require and what they do, plus a couple pointers to stay clear of overinsuring.

Various states have different laws, yet you can expect health and wellness insurance coverage (which many individuals get with their employer), car insurance (if you own or drive a vehicle), and house owners insurance policy (if you have home) to be on the listing (https://www.gaiaonline.com/profiles/hsmbadvisory/46584207/). Mandatory kinds of insurance can change, so inspect up on the latest laws once in a while, specifically prior to you renew your plans

Report this page